Taxing Les' Patience (and Property)

Today's guest blogger is Les Kniskern. Les is a constituent of mine from the Greater Rockwell neighborhood, not far from the Governor's residence. Les has been actively involved in community issues for some time now. Most recently, he has been engaged in efforts to mitigate the negative business impact from the station closures that have accompanied the CTA Brown Line Expansion Project.

Today's guest blogger is Les Kniskern. Les is a constituent of mine from the Greater Rockwell neighborhood, not far from the Governor's residence. Les has been actively involved in community issues for some time now. Most recently, he has been engaged in efforts to mitigate the negative business impact from the station closures that have accompanied the CTA Brown Line Expansion Project.His other passion has been the issue of skyrocketing property taxes and the underlying issue of how we assess properties in Cook County. Les is not a 'special interest', nor is he an 'insider'. His story and experience is that of many of my constituents, and he was interested in sharing them with readers here.

While there are various points that I would love to expound upon, and may at a later date, for today, I will try to stay on the sidelines for this post, and let those of you that choose to do so, debate the issue amongst yourselves or with Les.

For a related story, you can read Ben Joravsky's article in this week's Chicago Reader.

Without further delay, I give you Les Kniskern:

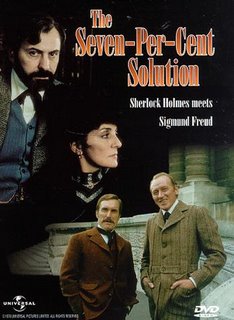

I’m tempted to post the phrase “7% solution” and let the comments fly, but since Rep. John Fritchey has graciously invited me to post as a guest blogger, let me share thoughts from a homeowner’s perspective.

My wife and I formed a partnership with another couple to purchase a

As first-time homeowners we never anticipated a 59% assessment increase in 2003, only one year after our purchase. This was not a rehab, we’re still hoping for the day when we can afford new windows – but the broken sewer line took precedence this year.

Our dear neighbors, elderly sisters who still resonate with the accents of their home country, worry with me over the fence as we discuss how to care for different plants in our garden. “What,” Otillia asks, “are we to do? How can we pay our taxes and keep our home?” Their home of 17 years, and 63% assessment increases.

Other neighbors, who’ve battled gang influence, cleaned up graffiti, and planted corner gardens to make this a neighborhood to be proud of, are no longer fearful of losing their possessions to crime, but of losing their homes to taxes.

There seems to be a perception that increased property values are a boon to the homeowner. Appreciation means more money in your pocket, right? Take the money and run. Yet, this boon is only offered to the investor who flips a commodity, or the seller who moves from location to location.

At the crux of the assessment debate is the homeowner whose interest lies not in profit, but in the home. Individuals seeking a residence with stability, a community in which to live, neighbors on which to rely. In order to build such a place, a commitment must be made to its residents. To make a stable community, and ultimately a better State of

Escalating assessments and out-of-control property tax increases threaten this type of homeowner.

The property tax debate must not be looked at as an “us” vs. “them” proposition, but rather as a delicate eco-system comprised of property owners, commercial interests, and political gain.

For a run-of-the-mill homeowner, understanding these complexities can be hard. Even more difficult is that the State of

The “7% solution” is a misnomer, whereas it should have been called the “7% bridge,” to a more permanent solution.