GOP's Requiem for the Hyper-Rich

Death and Taxes

The two words that just go together -- like Fear and Loathing.

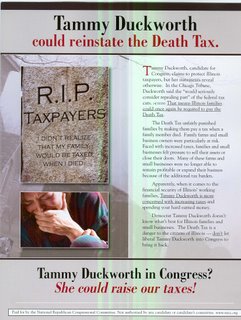

And in today's episode of GOP Mailing Melodrama, the National Republican Congressional Comittee brings all four.

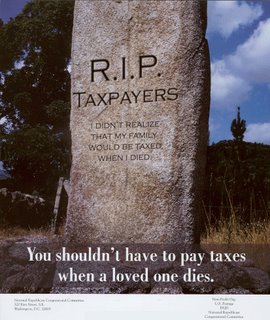

Of course the mailer in question also features low-budget cheesiness that we have come to expect from the NRCC's 6th District correspondence. First, there is pathos via clip art:

But it is somewhat unclear whether the woman in the clip art is trying to stifle her grief, her laughter or her vomit. Perhaps she witnessed something "just disgusting"...

And there is the now familiar odd-ball death imagery:

But there is no explanation why a multi-millionare -- the tax in question only applies to estates in excess of two million dollars -- would have such a battered headstone. And there are no clues as to why the deceased multi-millionare's family -- who, regardless of the size of the estate, inherit the first two million dollars tax-free -- didn't insist that the writing on the gravestone be written in parallel lines.

No one in my family will ever trigger the millionares' estate tax, but I would never EVER stand for such a shoddy headstone.

And there is the obvious question: Is this grave the home of the goofy ghost from the earlier mailer? The voters of the 6th District want answers!

But what about the substance of the mailer? Just as goofy.

"You shouldn't have to pay taxes when a loved one dies"? Okay, you don't have to.

All you have to do to avoid paying taxes "when a loved one dies" is not accept an inheritance from an estate of more than two million dollars. Not only is not inheriting millions my plan for avoiding the estate tax, everyone I know is going to avoid it that way.

And because the tax only applies to multi-million dollar estates -- less than 3 percent of deceased adults in 2002 had estates subject to the tax-- I'll bet that you and almost everyone you know will avoid the estate tax in exactly the same way.

And what about the claim that the multi-millionares' estate tax puts family farms and small business owers at risk?

The truth is that very few actually pay the estate tax.

The Tax Policy Center reports that in 2004, in all of the United States of America, roughly 440 taxable estates were primarily farm and business assets. And even considering estates in which farming or business was a sideline, the Center found only 7,090 taxable estates for 2004 that included any farm or business income. The estate tax repeal benefits primarily non-farmers and non-business-owners. People like the fellow pictured on the right:

And these hard workers:

But what about the mailer's claim that Democrat Major Tammy Duckworth just can't wait to spend your hard earned money?

Eric Krol of your Daily Herald reports that Maj. Duckworth has vowed to cut Congressional spending by ending the wasteful and corrupt practice of "earmarking" pork projects in Washingon. By contrast

Well, that sure ain't gonna slow Congressional spending.Republican congressional hopeful Peter Roskam, who’s always billed himself as a fiscal conservative, tried to walk a political tightrope Monday by embracing an oft-criticized budget tactic for securing federal funding for local projects. The 6th Congressional District GOP nominee said he’d support continuing the so-called practice of “earmarks” if elected to Congress[.]

So, in conclusion, here are two pieces of free advice.

First, to the NRCC: While it is okay to use cut and paste graphics with no connection to the 6th District in your mailings, you should not use cut and paste arguments about rampant Congressional spending when 1) your party controls Congress, and 2) your candidate has embraced pork barrel spending.

Second, to Republican readers: Please, please, please donate to the National Republican Congressional Committee. No, really. If you're a Republican and have only one dollar to contribute to the election in November, please send that dollar to the NRCC. Nothing would make my Democratic heart happier than to see GOP campaign dollars directed to the masterminds behind these mailings. So Republicans, please give to the NRCC, and give often.

In fact, you Democratic voters might want to contribute to the NRCC trainwreck as well.

17 comments:

This may be a duplicate comment.

I studied History with Joe Wall who wrote the biography of Andrew Carnegie.

Wall convinced me of the wisdom of a 100% inheritance tax. Carnegie believed in that. He thought no one should inherit wealth. Carnegie himself died broke having given all of his away.

I can argue 100% tax, or I can argue no tax i.e. I can agree with Carnegie; or else I can make the case that wealth and assests; instead of income... (like in Bush's ownership accounts for ssa) should be shared more widely and people allowed to pass it on to children.

I have a hard time arguing a rate between all or nothing...

How does Duckworth argue it?

Actually, nobody payes taxes when a relative dies; the estate pays the taxes. If you inherit anything, you don't have to worry about taxes; they've been paid. So the claim, "You shouldn't have to pay taxes when a loved one dies" is misleading and disingenuous.

Republicans for Duckworth comment my blog.

They agree the flier are all wrong,

The fliers say Duckworth favors several tax increases, all of which she expressly opposes (see her Web site.)

Her website says,

While I believe that the estate tax should be repealed for all but the wealthiest Americans, I oppose current efforts in Congress to tie that repeal to a needed increase in the minimum wage.

So she sounds like she's pretty much in the no death tax group. (Good!)

I'm not sure you make that clear above Austin.

If you figure the wealthiest have the smarts to avoid this tax all together; the burden must really fall rich, but not so rich (or maybe so smart) folks.

So I'm really not sure what it means to say only tax the most wealthy. They have plenty of ways out and I'm not certain who she would really hit.

So trash the tax all together I say. Keep the code simple.

PS Compare the R's for Duckam comment on Duckworth's plan for Iraq with the plan on her site.

They're different.

Here's the Schaumburg Review with Duckworth's comments on the estate tax. A little different than what's on her website.

As a member of the lower upper middle class... I'm not sure where all this protection of the middle class that Duckworth favors would leave me.

Both candidates agree on the portion of the Bush plan that provide families with per-child and child care tax credits. They also agree that income tax rate cuts and the repeal of the marriage penalty should be made permanent.

Duckworth has repeatedly called for an end to tax subsidies for the oil industry, and tax relief for middle-class -- but not wealthy -- families. For example, she disagrees with Roskam's position on the inheritance tax.

Currently, the tax hits only those individuals with estates valued at more than $2 million.

Duckworth cites statistics that say a full repeal of the it would add more than $300 billion to the federal deficit and benefit only 8,000 U.S. families.

The exemption level is scheduled to rise to $3.5 million in 2009. At that level, only 3 of every 1,000 people who die will have an estate large enough to owe any tax, according to the Center on Budget and Policy Priorities.

"There's different ways to be fiscally responsible while helping middle-class families and reigning in the budget. The Bush Administration has stood by while costs for middle-class families, such as tuition, health care and costs at the fuel pump, have gone up," Christine Glunz, Duckworth spokeswoman, said.

just in case you didn't know this...Roskam didn't send those mailing, the NRCC did. and by the way, it is against federal law for him to be involved. continuing to refer to these mailings as "Roskam's campaigning" is just patently false, and shows both a lack of education and a desire to remain blissfully naive

the paris hilton picture is nice. yesterday, there was a roskam-hugh hefner comparison. funny, since hugh's company PLAYBOY is a big donor of Tammy Duckworth

Paris Hilton is waste-o-space.

Roskam and Duckworth don't disagree much on taxes. It's just easier to see where Roskam is at, then it is with Duckworth.

I suspect Austin has a hard time admitting Duckworth and Roskam agree on this; so we get the Paris pics instead.

Joe...while you may be right, why would the blogger let the facts get in the way of his post?

Lets say a farm wife own's 200 Acres of Land (grossing about $20,000 a year), or a widower in Riverside owns a decent house outright. After 2011, upon death (given no tax avoidance shennanigans), their heirs would be paying 55% of the live savings of their ancestors to feed Washington DC's unstoppable spending.

Are these millionaires getting off scot free? Or just middle class people that have saved a bit of money, and don't want to send it to Washington DC?

How many farmers live in the Sixth district?

Landowners or farmers? I would guess there are a sizable amount of people with an estate greater than $1 Million in the 6th district, given the real estate boom in the area.

JBP

This statement is very telling

"the Center found only 7,090 taxable estates for 2004 that included any farm or business income."

Given that small business owners and farmers typically spend a large part of their waning years trying to avoid the death tax, there must be some very rich tax attorneys out there making tax avoidance schemes.

Alternatively, it is unlikely that much farm or small business income is shown once you retire. Much more likely to be dividends or cash rent.

JBP

Joe,

If you actually read the posts before commenting, you will see that I make frequent references to the NRCC as the exclusive source of the mailings.

So go donate to the NRCC right away.

Given that small business owners and farmers typically spend a large part of their waning years trying to avoid the death tax, there must be some very rich tax attorneys out there making tax avoidance schemes.

It's a welfare program for lawyers and accountants. Another reason to get rid of the Tax... it encourages non productive labor.

I'm becoming a flat-taxer in old age.

I just donated to the NRCC...and will do so again and again...while I'm at it, I just gave to Roskam.

GO PETER!

All anyone has to do to put a stop to this idiocy is start dressing up in Chinese military uniforms and waving Red China's communist flag outside Roskam events... The guy wants to continue dishing out inane Republican pork (Bridges to Nowhere...) while simultaneously cutting taxes even more for the elitist country-club 1%...

How do elephants like Roskam pay for those opposing programs (spending more while bringing in less)?

Why, the Republican Party and Peter Roskam just cut deals for massive IOUs with the Communist Party of China. Of course.

Wave that red and yellow flag Petey, wave it proud.

Better Red than Dead!

Post a Comment